Cash Flow Projections for a Consumer Financing and Loan Servicing Company in the USA

About the Client

The Business Challenge

For a given pool of loans, generate cash flow projections such as total paid, principal and interest, balance, and defaults for each time period.

What Aptus Data Labs Did

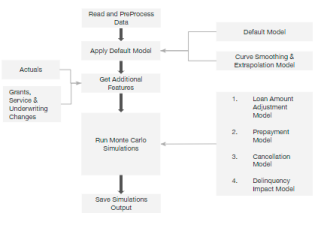

Built a Cashflow Model framework based on Monte Carlo simulation since the dynamics of payments, defaults, and other events are all interdependent and inherently uncertain. Moreover, the model is a multi-period loan-level simulation with modular submodels for - ML-based Probability of Default, Cancellation, Prepayment, Loan Amount Adjustment and Delinquency.

The Impact Aptus Data Labs Made

Accurate cashflow projections by the Model framework developed by the Aptus team provided valuation analysis to the client and insights to identify the healthy pools of loan to finance. The Aptus team built a challenger Probability of Default model with accuracy boosted by 4%, improving the credit underwriting process.

The Business and Technology Approach

- The Aptus team began by examining the client's loan portfolio to determine sources and concentrations of risk.

- The Cashflow Model framework consists of the following components and submodels: 1. Loan Cancellation Model 2. Loan Amount Adjustment Model 3. Prepayment Model 4. Delinquency Adjustment Model

- Developed the ML based Probability of Default (PD) model using features such as FICO score for applicants and co-applicants, EFC grants, CRM fields, service impact changes, demographic data etc.

- Implemented smoothing and extrapolation of PD model as 1. non-monotonicity and fluctuations in estimated cumulative PD needs smoothing, and 2. estimation of cumulative PD for longer horizons needs extrapolation.

- Performed Roll-Rate Analysis to determine the percentage of loan accounts that transition to a better, worse or remain in the same delinquency state.

- Estimated static pool cashflow projections using 10,000 Monte Carlo simulations leveraging all sub-models.

- Validated the performance of the framework using backtesting.

Tools Used

R, Python, Amazon EC2, RDS, Postgresql, Quicksight.

The Outcome

- Provided valuation and advisory services to the client to finance a pool of loans on their balance sheet.

- Improved accuracy of the Default Model by 3 to 4% and cumulative cash flow projection by 11%, enhancing their cash management.

Related Case Studies

Unlock the Potential of Data Science with Aptus Data Labs

Don't wait to harness the power of data science - contact Aptus Data Labs today and start seeing results.

If you’re looking to take your business to the next level with data science, we invite you to contact us today to schedule a consultation. Our team will work with you to assess your current data landscape and develop a customized solution that will help you gain valuable insights and drive growth.