Alternative Home Financing Solutions for an Australian Company

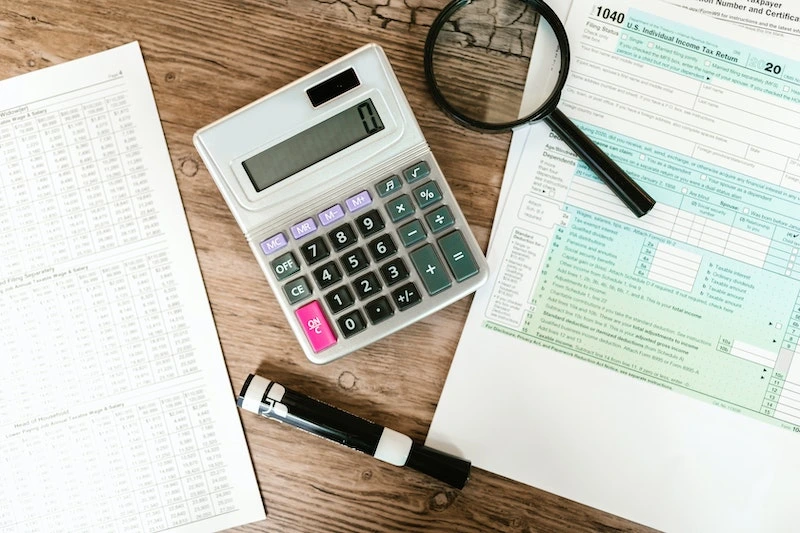

About the Client

The Business Challenge

The client wanted to predict credit risk complying with the International Financial Reporting Standard. They also wanted the solution to be implemented on a platform where all processes, such as Probability of Default (PD), Loss at Given Default (LGD), and Exposure at Default (EAD) to calculate the Expected Credit Loss (ECL) can be automated. The client also wanted the solution to take in financial and economic variables.

What Aptus Data Labs Did

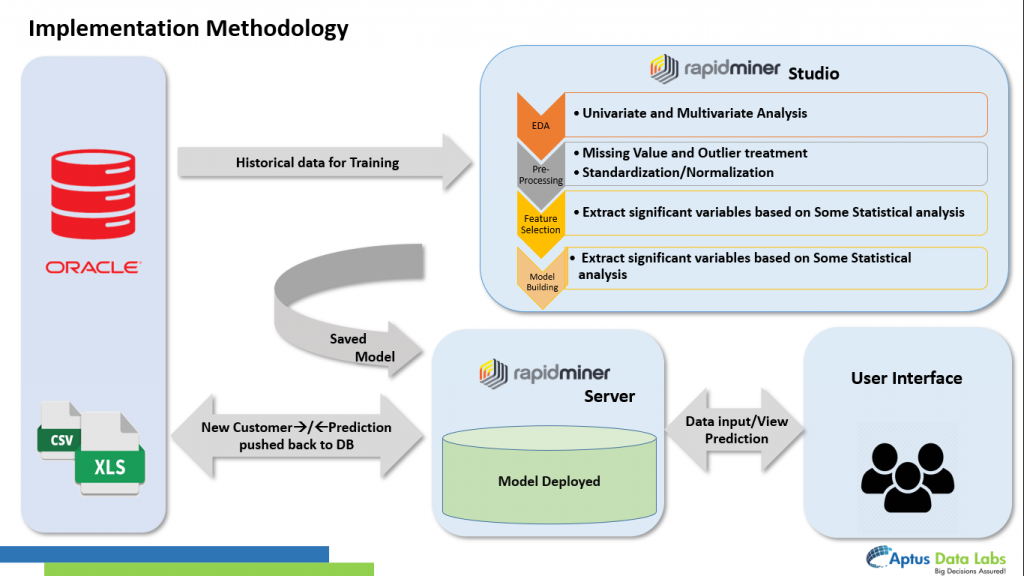

We built an advanced AI/ML-based engine to predict the credit risk complying with IFRS 9. We used RapidMiner and Python to create an automated process that took either the member id or the entire record as input to process through multiple sub-processes to create the desired output.

- Building Credit Risk Model: Developed an IFRS 9 Compliant Risk Model to predict PD (Probability of Default), LGD (Loss at Given Default), EAD (Exposure at Default), and ECL (Expected Credit Loss) with both account prediction and customer prediction options to identify defaulters.

- Risk Behavior Analysis: Identified all the important drivers required to regularly track customer credit history. Ranked the drivers concerning to contribution to PD, EAD, and LGD (EL = PD * LGD * EAD), and multiple types of MIS for business users’ consumption.

- Professional Services: Time-to-time monitored the model performance by Accuracy, False Positive Rate, and current MIS reports for management. Quarter-on-quarter review and model calibration included when necessary.

The Impact Aptus Data Labs Made

The new AI/ML-based predictive engine enabled the client to assess the possibility of the borrower’s repayment failure and the loss caused to the financer for non-payment. The client was also able to predict or measure the risk factor of any transaction that helped the client to plan with strategies to tackle a negative outcome. The client could also set up credit models to determine the level of risk while lending.

The Business and Technology Approach

We used the following process to meet and resolve the client’s business challenge. We:

- Collected historical data to understand and identify the most impacting features for a solution that includes member ID, loan amount, loan status, funded amount, term, interest rate, installation, homeownership, and DTI (debt to income ratio).

- Did an extensive data preparation to feed the selected features into the model.

- Evaluated the model with several metrics for PD, LGD, and EAD.

- Developed a set of models each for PD (Probability of Default), Loss at Given Default (LGD), and Exposure at Default (EAD) to calculate ECL (Expected Credit Loss).

- Deployed the model on the RapidMiner server and exposed it to an API-based web service for client interaction to be easily integrated with any third-party client.

- Identified the data to use, retrain, and refine the data pipeline to maintain the consistency of the model performance.

Architecture

Related Case Studies

Unlock the Potential of Data Science with Aptus Data Labs

Don't wait to harness the power of data science - contact Aptus Data Labs today and start seeing results.

If you’re looking to take your business to the next level with data science, we invite you to contact us today to schedule a consultation. Our team will work with you to assess your current data landscape and develop a customized solution that will help you gain valuable insights and drive growth.